Valuation Creep - Getting Mainstreamed?

Over the last decade, lulled by low interest rate, ageing demographics and need for savers to earn higher yields – many global investors embraced longer term instruments or long duration optionality (new age companies/nascent technologies) to get some extra yield.

For instance, in fixed income: 100 year bonds – some for a coupon of less than a percent (Austria) to some paying in the region of 5% (Mexico) to 8% (Argentina). A2bn Euro bond issued in June 2020 by Austria (close to peak of Covid, where government announced massive fiscal stimulus plans across the world) for maturity in 2120, paying a coupon on 0.88% - significantly lower than 2% paid for 100 year bond launched in 2017. Buoyed by huge fiscal stimulus, supply chain bottlenecks, an unexpected war in Europe – inflation has reared its ugly head and prices of such bonds have nosedived. From its peak in 2020, bond has fallen by more than 70% - given the dramatic rise in interest rates.

And while Austria/Eurozone may survive and honour its commitments, it is intriguing to see how yields of Argentinian 100 year bonds were lapped up when it was launched in 2017 – just 1 year after it emerged from its default. A 100 year bond by a country which has seen a default almost every 20 years – at a dollar yield of 7.9%. Since its launch in 2017, the Argentinian Peso has been on a tailspin (USD/Argentina Peso was 15.8 in June 2017, and currently trading at 156, so effectively 90% devalued). And so in 3 years since its launch, these bond-holders agreed for a haircut of approximately half!

While above were experiences of longer dated debt instruments, assets like residential real estate and equities are essentially longer-dated instruments with optionality of survival – given that there are no fixed “coupons”. Compared to most developed markets, where rental yields are closer to mortgage rates - in India, residential rental yields are significantly lower than mortgage rates. The implicit assumption being in a “growth” market like India, property appreciation will make good for the poor rental yields. While generally, property investing in growth markets within India has netted good returns, we did see a sluggish phase over the last decade, as gains in previous cycle (2004-12) got adjusted.

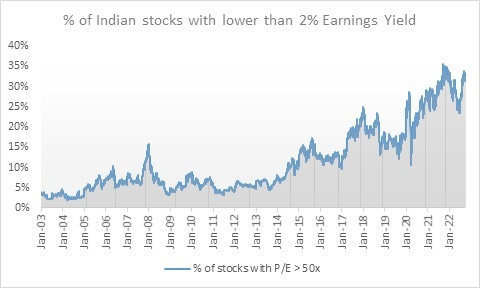

Coming to equity markets, we have witnessed one of strongest phases of valuation creep over the last 2 decades. Almost a third of Indian stocks have earning yield of less than 2% (or P/E of more than 50x on trailing 12 month earnings), with 6% of companies with P/E of more than 100x (or earnings yield of 1% or lower). (Universe is companies which have been among Top 500 companies at any point in time). Investing in these companies is a bet on longer-term survival of these franchises as well as ability of these companies to grow significantly ahead of economy, over decades.

(Source: KotakMF)

While pre-covid, India Inc was plagued by weak earnings profile amidst large corporate losses, and so one could argue very few companies were reporting steady growth and therefore their valuation expanded (in effect, scarcity premium for growth), post Covid the number of companies at less than 2% (or 1% earnings yield) have further gone up!

Different sectors have differing earning cycles (and maybe some of these companies have low earnings now, but can cyclically improve in the years ahead), and so another way to see valuation creep is to look at Price to Sales Ratio. Made (in)-famous by quote of Scott McNealy of Sun Microsystem, while discussing his firm during dot-com times.

“…we were selling at 10 times revenues when we were at $64. At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?”

Data from Bloomberg shows almost 7% of all firms listed in US had Price to Sales more than 10x in dotcom bubble (bubble in hindsight) – a level seen similar to highs in 2021. Since then, large value erosion in tech/unprofitable companies etc primarily due to rising interest rates have pulled this number to less than 4%- closer to its longer term average.

Presenting the same data (for companies listed in India with market cap > 100cr).

(Source: Bloomberg)

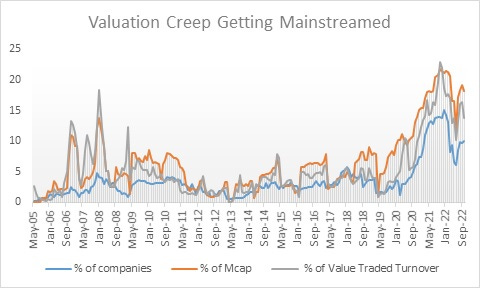

The previous peak was in 2007 (pre GFC), which was breached in 2021, and while it briefly corrected, it has again bounced back closer to 12%.

And it is not that these companies are in fringes, with very few owning or trading it. As this chart from Elara Securities point out, for NSE500 (ex-financial), the percentage of companies with Price to Sales greater than 10 account for 10% of universe, in terms of market-cap, it is 18% of universe and in case of monthly trading value on exchanges, it accounts for 14%. The Valuation Creep is getting mainstreamed!

(Source: Elara Securities)

Does this mean crash is inevitable, or one should sell all such companies? Absolutely not! The answer is lot more nuanced. Either one needs to be an astute trader and know when to exit such companies with a well thought out trading plan, or have a diversified portfolio across sectors and companies across valuation ranges. But more importantly, not every company in this “vaulted league” is same. Some of them have genuinely long growth runways and strong competitive positions, but many are impostors, deriving benefit of being part of the same sector or common externality (like commodity upswing etc). It is like Austria and Argentina – in one case while there can large valuation correction, in the other, damage can be permanent. Choose within this cohort wisely, and most importantly, at such high valuations, be prepared to be invested in long haul – in tens of years at least! Claim on a company/sovereign – either debt or equity is essentially an implicit bet on survival of company/sovereign in its current form. Large re-rating lead gains are in some sense taken from the future, and one must prepare for long investing horizons to enjoy the fruits of investing in such companies at such exalted valuations.